Greater value through the power of preferred pricing

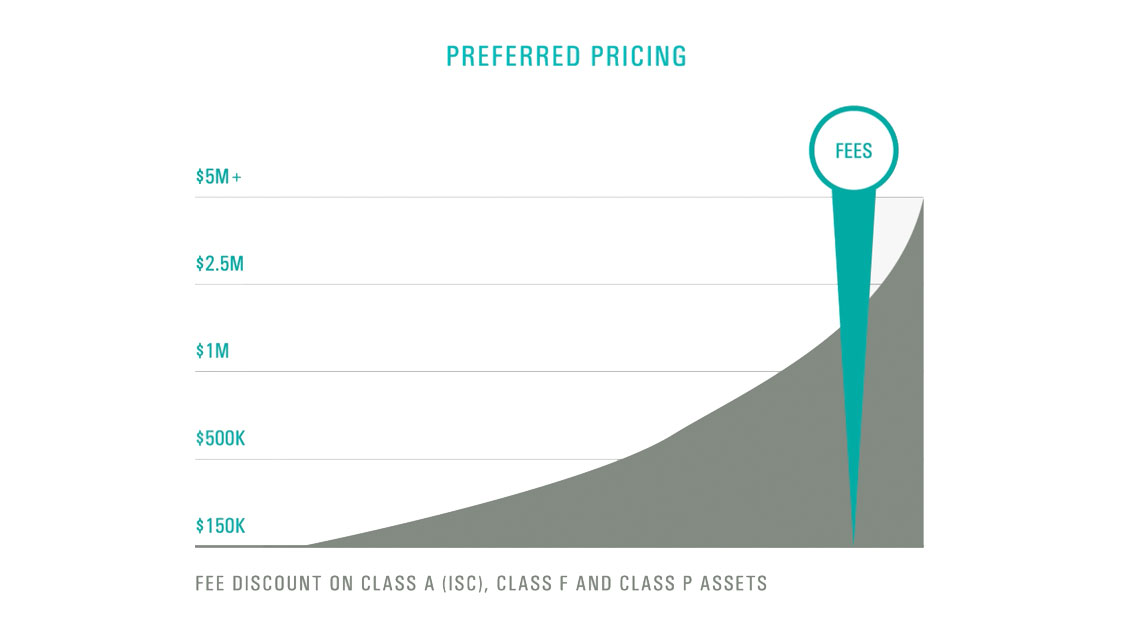

The concept is simple. The more assets you invest, the lower the management and administration fees on your investments.

Starting at the $100,000 level, preferred pricing reductions are automatically applied to management and administration fees for Class A (ISC), Class F and Class P assets.

As your assets grow, so do the fee reductions – additional discounts automatically apply at the $500,000, $1 million, $2.5 million and $5 million asset levels. Automatic fee reductions for Class A (ISC) and Class F securities ensure you receive preferred pricing, going back to dollar one.

CI performs asset assessments every Friday, so your investments are well positioned to receive preferred pricing as soon as you reach the qualifying asset levels.

High watermark protection

CI Private Wealth uses high watermark protection. The high watermark is the highest peak in value of an individual account or aggregated assets of a Family Group achieved since the launch of preferred pricing.

This means that you have the benefit of reduced fees when market performance places you into a higher asset level, but you are not penalized for negative performance.

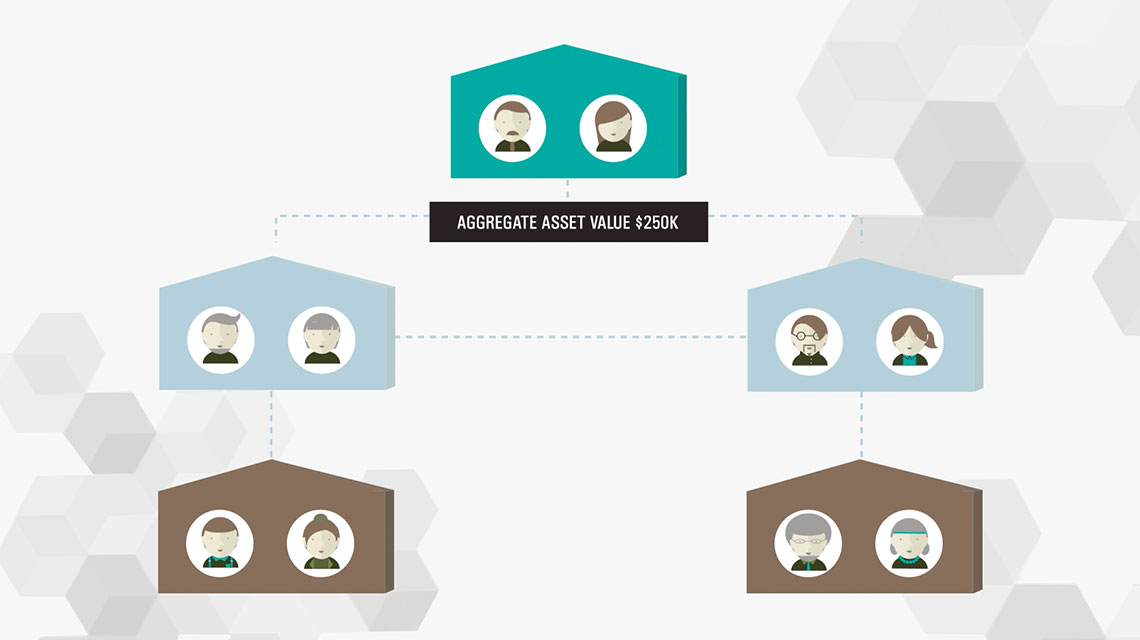

Extended family pricing

Receive fee reductions sooner. Multiple accounts for an individual investor or extended family members can be linked as a Family Group for pricing purposes once a family threshold of $100,000 is reached.

A Family Group can be comprised of parents, children and/or siblings, grandparents, grandchildren, great-grandchildren, the spouses of each of these persons, and a corporation of which any family member owns more than 50% of the voting equity.