|

|

|

|

|

|

| |

|

| CI Multi-Asset Management is responsible for the construction and management of CI Investments' managed solutions programs. Based in Toronto, the team oversees more than $40 billion of assets invested in customized managed portfolio solutions for individuals, families and businesses and is led by portfolio manager Alfred Lam. |

|

CI Multi-Asset Management

| |

|

|

Alfred Lam, CFA, Senior Vice-President and Chief Investment Officer, leads the CI Multi-Asset Management team. Mr. Lam has over 16 years of experience specializing in portfolio design, asset allocation, manager and fund selection, and risk management. While at CI, Mr. Lam has brought unique ideas and processes to the management of the team's multi- asset strategies, including a mean-reversion currency management strategy, the concept of investing in concentrated and benchmark- agnostic portfolios, and a new approach to risk management. In addition to the CFA designation, Mr. Lam holds an MBA from the York University Schulich School of Business, and is a member of the CFA Institute and the Toronto CFA Society. |

Investment philosophy

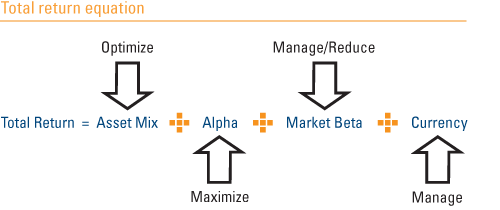

CI Multi-Asset Management embraces the philosophy of active management and applies it to all aspects of its investment process. The term active management stretches beyond the practice of stock selection. The team views active management as a process that strives to identify and manage all the variables and factors that can influence an investor's total return.

Portfolio construction

Asset allocation must be applied intelligently to ensure that a portfolio generates sufficient returns for the level of risk it is taking. CI Multi-Asset Management believes it is critical to have a clear understanding of valuations, fundamentals and correlations in order to construct and manage efficient portfolios. A portfolio that combines asset classes exhibiting negative or weak correlations with each other has greater opportunities for improving risk-adjusted returns. Using a multi-asset-class framework offers the best opportunities to benefit from imperfect correlations.

- Strategic asset allocation: The team uses a strategic asset allocation strategy to construct each portfolio and regularly reviews the strategic asset mixes to ensure that they are reflective of the evolving market environment. CI Multi-Asset Management uses its own capital markets expectations driven by valuations and fundamentals and also considers research from State Street Global Advisors (SSGA), a global investment manager with over $2 trillion US in assets under management.

- Tactical income allocation: In response to today's low-yield environment and increased volatility in the bond markets, CI Multi- Asset Management will reposition its income-oriented portfolios more frequently to benefit from quickly changing valuations.

- Option strategies: From time to time, CI Multi-Asset Management may employ options strategies to implement asset allocation strategies and to generate incremental yield.

|

|

|

|