Tax Efficiency

T-Class: tax efficiency when drawing monthly cash flow

T-Class is a tax-efficient solution from CI Investments that creates a customized stream of predictable tax-deferred cash flow, without sacrificing a choice of investments. T-Class can provide more after-tax income than conventional systematic withdrawal plans because its distributions are in the form of non-taxable return of capital.

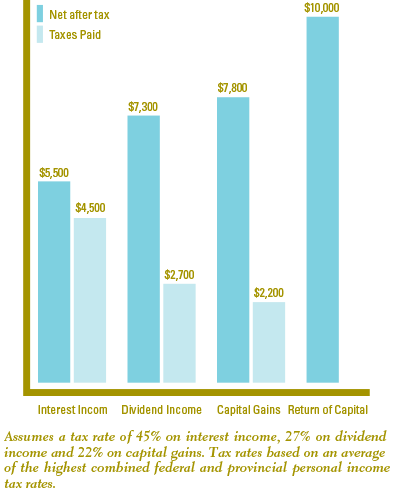

This chart compares the net amount a client can expect to receive of $10,000 worth of cash flow, depending on how it's generated.

Four of Portfolio Series' portfolios – Balanced Fund, Balanced Growth Fund, Growth Fund and Maximum Growth Fund – are available in T-Class.

By using T-Class, you can:

- Create a predictable, tax-effective stream of monthly cash flow to meet your needs without sacrificing the potential for growth.

- Customize your payment by selecting a percentage or a fixed dollar amount per month.

- Allow your investments to continue growing at rates that can potentially match, or outstrip the rate of withdrawal.

To learn more, visit CI's T-Class website at www.tclass.ca.

Your TFSA can be used for investing – and Portfolio Series is an ideal investment to hold in a TFSA. You can contribute up to $5,500 every year to your TFSA, and your assets will benefit from tax-free growth. Also, you pay no taxes when the assets are withdrawn.

More details are available on CI's TFSA website at www.ci.com/tfsa.