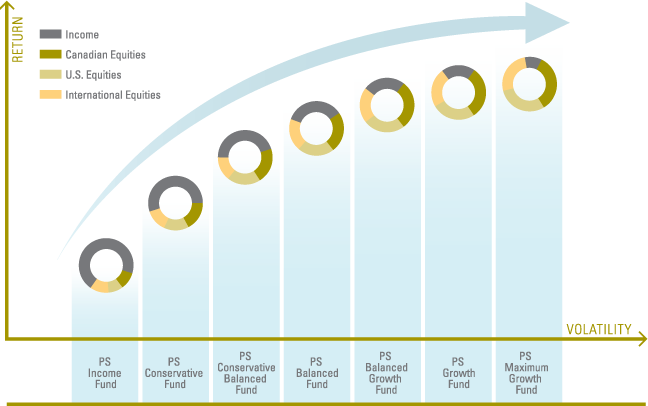

A portfolio for every investor

Portfolio Series offers seven optimized portfolios that lie on the efficient frontier – meaning they are designed to maximize returns while minimizing volatility for that level of risk tolerance.

Portfolio Series Income Fund — This portfolio is best suited for investors whose primary need is income and capital preservation. The focus is on income with a diversified basket of bond, income and income-oriented equity funds. The fund provides an income stream through fixed monthly distributions.

Portfolio Series Conservative Fund — Best suited for investors looking for capital preservation and income with some growth from the equity portion of the portfolio. The income component is diversified between bond and other income funds.

Portfolio Series Conservative Balanced Fund — Split between equities and income and with broad diversification across asset classes, geographic regions, economic sectors and investment styles, this portfolio is best suited for investors whose primary objective is capital preservation with some growth.

Portfolio Series Balanced Fund — This portfolio has a greater equity weighting while curbing volatility with a strong component of income investments. It is best suited for investors pursuing long-term capital growth who are conscious of volatility.

Portfolio Series Balanced Growth Fund — This portfolio has a significant equity weighting while the income component helps to dampen volatility. It is best suited for investors pursuing long-term capital growth who are conscious of volatility.

Portfolio Series Growth Fund — Offering well-diversified exposure to Canadian, U.S. and international equities, this portfolio is for long-term investors who are seeking strong capital growth and are comfortable with some short-term volatility.

Portfolio Series Maximum Growth Fund — Best suited for aggressive investors, this portfolio is constructed to provide maximum expected returns in the long term along with higher volatility in the short term. It has well-diversified exposure to Canadian, U.S. and international equities, along with a small allocation to high-yield bonds.