More cash flow with less tax

Within PIM, T-Class can be used to create a customized, tax-effective stream of monthly cash flow without sacrificing a portfolio's potential for growth.

With T-Class, investors can:

- Receive monthly payments paid as non-taxable return of capital (ROC).

- Continue to benefit from tax-deferred compounding.

- Adjust payouts to preserve access to government benefits.

- Choose from more than 50 Corporate Class mandates.

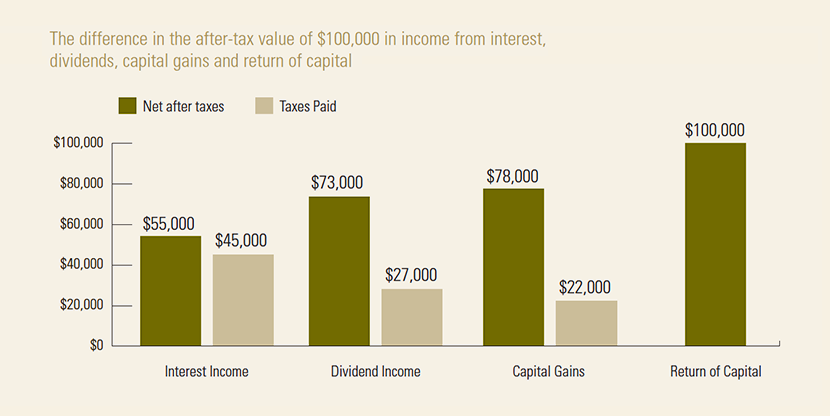

Assumes a tax rate of 45% on interest income, 27% on Canadian dividend income and 22% on capital gains. Tax rates based on an average of the highest combined federal and provincial personal income tax rates. Please note that T-Class may pay taxable annual dividends in addition to the return of capital payments.